January is Financial Wellness Month! What better way to kick off 2026 than to learn how to build a budget and stick with it? If your New Year’s resolution is to save money for a car or house, pay down debt, or better understand your spending habits, this article is for you.

We’ll walk you through building a budget in five steps:

- Step 1: Calculate your take-home pay

- Step 2: Understand how you spend and sort expenses

- Step 3: Choose a budgeting method you can stick to

- Step 4: Build your first version of your budget

- Step 5: Set up a system that helps you stick to it

One quick note before we start. Budgets look different for everyone. Your income, debt, goals, and family situation shape what “realistic” looks like. Use these steps as a framework, then adjust as your life changes.

Step 1: Calculate your take-home pay (use net income, not gross income)

Start with your take-home pay and include any net income from a side hustle or other work. Build your budget with net income, not gross income, because net income shows what you actually have available to spend and save.

Example: You earn $4,500 per month in gross income. After taxes and deductions, your net income comes out to about $3,900. Build your budget around $3,900 because that number reflects what you actually have available.

What if you have irregular income?

If you are self-employed, run a business, or work as a freelancer or contractor, your income may change from month to month.

- Start with a conservative number so you do not overcommit

- Set a baseline using your lowest typical month

- Add a buffer category for “income swings”

- Set aside money for taxes if needed

Now that you know what you have to work with, you can move to Step 2.

Step 2: Understand how you spend your money and sort expenses

Step 2 helps you understand where your money goes so you can build a budget that reflects real life. This step can feel uncomfortable, but it gives you clarity and control.

Pull the last few months of spending

Review your bank and card statements for the last two to three months. Look for patterns and totals, not perfection.

As you review, flag categories that surprise you, like dining out, daily coffee runs, subscriptions, convenience spending, and impulse buys. If you feel up to it, total them up.

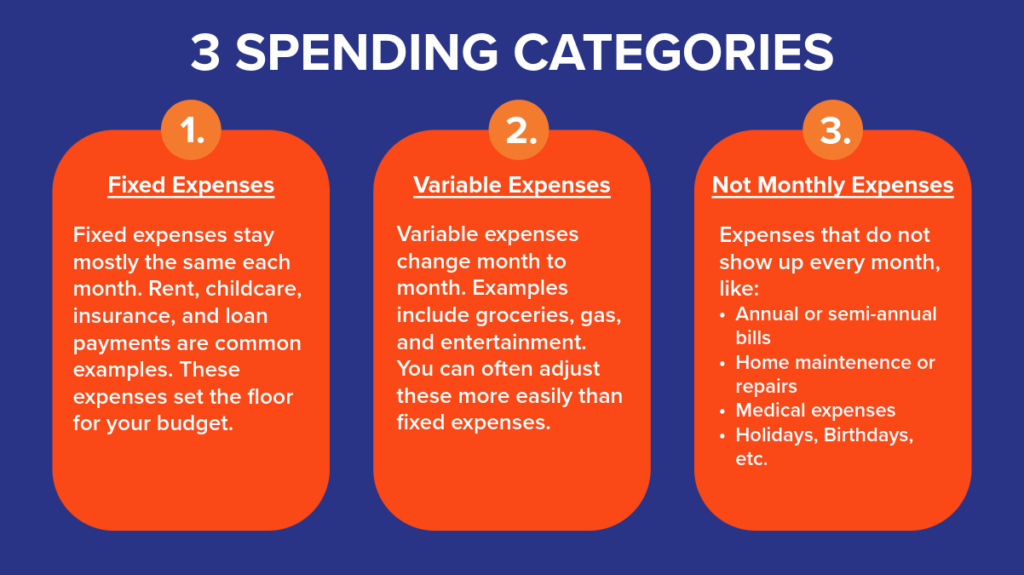

Sort spending into three categories

This step makes budgeting easier because you can see what you must pay, what changes month to month, and what sneaks up on you.

- Fixed expenses

Fixed expenses stay mostly the same each month. Rent, childcare, insurance, and loan payments are common examples. These expenses set the floor for your budget. - Variable expenses

Variable expenses change month to month. Examples include groceries, gas, and entertainment. You can often adjust these more easily than fixed expenses. - Not monthly expenses (the budget breaker category)

Some expenses do not show up every month, but they still belong in your plan, like:- Annual and semiannual bills

- Car repairs and home maintenance

- Medical expenses

- Holidays, birthdays, and school costs

Now you can choose a budgeting method that fits your goals.

Step 3: Choose a budgeting method you can stick to

There is no single best method. The best method is the one you will use consistently. Below are three common approaches, plus guidance on who each one fits.

Option A: 50/30/20 (use it as a starting point)

50/30/20 splits your take-home pay into three buckets:

- Needs (roughly 50%)

- Wants (roughly 30%)

- Savings and debt payoff (roughly 20%)

If your net monthly income is $3,900, those buckets look like this:

- Needs: $1,950

- Wants: $1,170

- Savings and debt payoff: $780

Use this method if you want a simple structure. Adjust the percentages to match your reality, especially if housing, childcare, or debt takes a bigger slice of your income.

Option B: Zero-based budgeting (give every dollar a job)

Zero-based budgeting assigns a job to every dollar of take-home pay until you have $0 left unassigned. You do not spend everything. You assign everything on purpose.

Use this method if money feels tight, you want clear control, or you want fewer surprises.

Example zero-based budget ($3,900)

- Rent: $1,650

- Utilities: $250

- Bills: $300

- Loan payments: $350

- Food: $600

- Gas: $200

- Miscellaneous: $300

- Savings: $250

Total assigned: $3,900

If you want to start simple, begin with your main categories (housing, food, transportation, debt, savings). Add more detail later.

Option C: Pay-yourself-first (reverse budgeting)

Pay-yourself-first budgeting means you set a savings or debt payoff amount first, then build the rest of your budget around what remains. This approach helps you make progress on goals before day-to-day spending fills up the month.

Example Pay-Yourself-First Budget ($3900/month)

Pay yourself first (goals first): $600

- Savings or extra debt payoff: $600

Money left for the rest of the month: $3,300

- Rent: $1,650

- Utilities: $250

- Bills: $300

- Minimum loan payments: $300

- Food: $450

- Gas: $250

- Miscellaneous: $100

Use this method if you have steady income and you want to prioritize saving or paying down debt. Start with a realistic amount so you can repeat it each month.

Step 4: Build your first version of the budget

Now you turn your numbers into a plan. Keep your first version simple. You can refine it after 30 days.

Choose your categories

Use categories that match your life and keep the list short enough to manage.

- Essentials: Housing, utilities, food, transportation, insurance, childcare

- Financial priorities: Savings and debt

- Flex spending: A category that keeps your plan realistic

Set targets using real numbers

Use what you found in Step 2 to set your first targets. Start close to your average spending, then adjust one or two categories at a time. After 30 days, review what worked and tighten or loosen targets based on real results.

Create a plan for bill timing

Bill timing can make a solid budget feel stressful. Map your paydays and due dates so you know what each paycheck needs to cover.

Write down:

- Your paydays

- Your bill due dates

- Bills you pay weekly, monthly, quarterly, or annually

Then assign bills to a specific paycheck so you avoid mid-month stress. Sun East members with checking accounts and direct deposit set up can access their paychecks up to two days early through Early Payday, giving you a bit more wiggle room when it comes to bill timing.

Avoid mid-month cash crunches

Mid-month crunches often come from bill timing, surprise expenses, or overspending early in the month. To prevent them:

- Build a small buffer, even if you start with $25 to $50 per paycheck

- Keep a short list of expenses you can pause when the month gets tight

- Set aside a little each month for not monthly expenses

Step 5: Set up a system that helps you stick to it

Your budget will work better when you pair it with reminders, automation, and quick check-ins.

Automate the important expenses

Automation helps you stay consistent even when life gets busy.

- Bills: use autopay for essentials or set reminders if you prefer manual payments

- Savings: schedule an automatic transfer on payday, even if you start small

- Debt payments: automate the minimum payment and add extra payments when you can

Conduct a weekly check-in (10 minutes or less)

Pick a consistent day each week and do a quick review. Check spending, upcoming bills, and any category that needs an adjustment.

Use simple guardrails

- Set up spending alerts for low balances or large purchases

- Use a 24-hour pause rule for non-essential purchases, especially online

Common budgeting mistakes and how to avoid them

Making the budget too strict

Do not set targets that feel impossible. Build breathing room with flex or miscellaneous spending. If you overspend in one area, adjust the plan instead of abandoning it.

Forgetting irregular expenses

Irregular expenses feel like surprises when you do not plan for them. Set aside a little each month in a not monthly category or sinking fund.

Trying to overhaul everything at once

Pick one or two changes that make the biggest difference. Build from there.

Not reviewing the budget until something breaks

Review your budget weekly so you can catch issues early and adjust before the month gets away from you.

Set Yourself Up for Financial Success in 2026

You do not need a perfect budget to make real progress. Keep coming back to your plan, review it regularly, and make small improvements over time. Consistency will support your financial goals throughout 2026 and beyond.